When you’re a small business, you can find it hard to hire an in-house accountant or a bookkeeper purely because there’s not enough work for them to justify sitting at your office nine to five, Monday through Friday. This is exactly why you can use the services of a virtual bookkeeper. Virtual bookkeepers can easily take care of several small businesses’ accounts. Small business owners can have their entire bookkeeping handled at a fraction of what they would pay an in-house bookkeeper.

However small your business is, you shouldn’t tackle your company’s finances on your own, unless you have bookkeeping experience and even then, you shouldn’t spend your valuable time on repetitive tasks if you can outsource them.

Before we move on to our top picks of online bookkeeping services that can help you tidy up your finances, let’s learn a thing or two about small business accounting.

Table of Contents

What is small business accounting?

Small business accounting as a not-so-interesting under-the-hood operation is a searchlight that you as a business owner use to shine a light on your company’s financial facets. It consists of keeping records of sales, expenses, assets and debts your company owes. You can keep records of these facets by working with a virtual bookkeeping service that handles at least the following:

- Balance sheet statements

- Profit and lost (P&L) statements or income statements

- Cash flow statements

Entrusting virtual bookkeepers with the task of handling your finances keeps you safe from snags such as vendor disputes, government audits or IRS penalties.

What is virtual bookkeeping?

Virtual bookkeeping is remote bookkeeping where accountants handle your business’s balance sheet, profit and loss statement, monthly reconciliation and cash flow statement online via an accounting and/or bookkeeping software. In addition to the foundational bookkeeping services, virtual bookkeepers can also handle your payrolls, tax prep, invoicing, inventory management and more. They can do anything an in-house bookkeeper can. Their physical presence is not of the essence.

Below are six virtual bookkeeping solutions that we believe will work best for your small business in 2022.

Bookkeeper 360: extensive virtual bookkeeping for small businesses

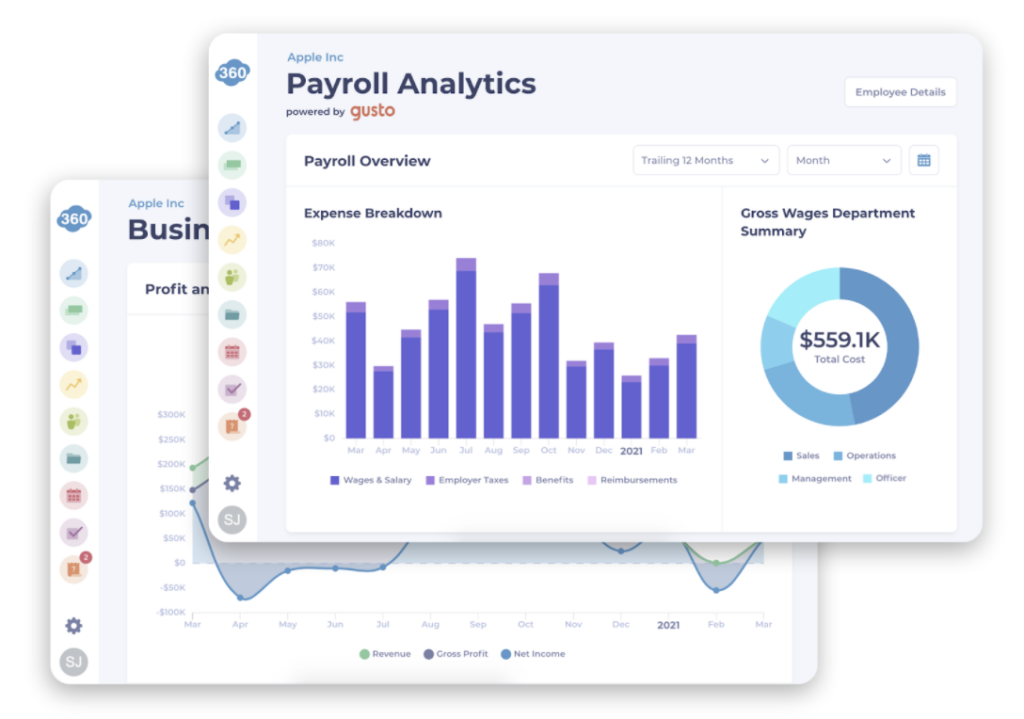

Bookkeeper360 truly is a value-for-money platform, even though it comes at a higher price than some of its competitors. It comes fully integrated with three major accounting and payroll software – Xero, QuickBooks, Gusto, ADP it has an incredible range of cheap additional services which can literally replace your in-house bookkeeper.

This fact really hits home when you consider that remote work will pour over into 2022 for at least the first quarter.

When you take into account that in-house bookkeepers earn anywhere between $35,530 and $56,947 a year, the average yearly cost of Bookkeeper360 of roughly $10,000 suddenly sounds really affordable. Please keep in mind that their services can be costlier if your monthly expenses exceed $20,000.

Because Bookkeeper360 is integrated with Xero and QuickBooks, both service-based and product-based businesses will use it. This is because both accounting software have time tracking and inventory management features, crucial for these two business models.

Pricing

Bookkeeper360 offers 3 plans: pay as you go, monthly and weekly. All are available for either cash or accrual-based accounting methods. Prices stated on the website are for businesses with monthly expenses of up to $20,000. Companies with higher monthly expenses would have to contact Bookkeeper360 for a quote.

- Pay-as-you-go is an hourly offer, where you get to communicate with your dedicated accountant for $125 per hour of support.

- The monthly plan is $349/month for cash-basis and $499/month for accrual-basis accounting.

- The weekly plan is $499/month for cash-basis and $699 for accrual-basis accounting.

Monthly and weekly plans include best-in-class support, monthly reconciliation, profit & loss and balance sheet. The monthly plan gets you a dedicated accountant, while the weekly plan gives you a dedicated accounting team, as well as weekly updates and advanced reporting.

Additional solutions include CFO advisory ($1000 per quarter), tax ($200-$800 per filling), payroll & HR (starting at $45/month) and back-office services (starting at $99/month).

Pros

- Dedicated accountant/accounting team (depending on your pricing choice)

- Available for both cash-based and accrual accounting methods

- All plans include monthly reconciliation profit & loss and balance sheet

- Bill pay available

- W-2’s and 1099’s available

- Affordable back office, payroll & HR services (starting at $99 and $45 per month)

- Integrated with Xero, QuickBooks and Gusto accounting/payroll software

- All accountants are US-based

- Has a mobile app that’s now integrated with Xero, QuickBooks and Gusto

- Flexible pricing options – you can either pay $125 per hour of support or select a monthly or a weekly pricing plan

- Mobile app available on a trial with no credit card details required

- CFO advisory available

Cons

- Compared to some of its competitors, it is a costlier option and depending on your business size, it might not be a right fit

- The fixed pricing is only available for monthly expenses up to $20,000, everything above is quote-based

- No catch-up bookkeeping

- No free trial

Final thoughts

If you need to spend more time on developing your small business or enterprise and can’t afford to delve into a rabbit hole that bookkeeping can turn into, Bookkeeper360 is a great choice. It can handle all of your bookkeeping duties at a price that’s lower than what would hiring an in-house bookkeeper. The icing on the cake is that all their accountants are US-based who will understand your business needs.

Xendoo – a bookkeeping software with something for everyone

Not many virtual bookkeeping services offer the range of pricing plans that Xendoo does and that’s exactly why it can be every businesses’ bookkeeping software of choice. This is especially true for small businesses in the early stages of their growth that probably only need basic bookkeeping.

Add to that the fact that their cheapest package comes at just $195/month and that they don’t enforce annual subscriptions and you’ve got yourself a true financial sidekick. IF you only need cash-based accounting. We’ll talk about this snag later on, let’s first see how the pricing is structured and what are the upsides to Xendoo.

Pricing

- Hustle at $195/month for monthly expenses below $20K

- Boost at $295/month for monthly expenses below $40K

- Flight at $385/month for monthly expenses below $60K

- Thrive at $495/month for monthly expenses below $100K

- Venture at $945/month for monthly expenses over $100K

Pros

- Very affordable basic bookkeeping

- Clearly outlined pricing structure

- Dedicated US-based CPA bookkeeper with every plan

- Robust integration (Quickbooks, Xero, Gusto, A2X, Amazon, TaxJar, Stripe, Shopify, Expensify, Bill.com)

- All plans include:

- Dedicated bookkeeper

- Cash basis bookkeeping

- Profit & Loss statements

- Balance Sheets

- Monthly trend graphs

- Mobile app

- Standard chart of accounts

- Both monthly and annual plans are available

- They do catch-up bookkeeping

- Both service-based and product-based businesses can use it

- Payroll services covered through Gusto integration

- Has a mobile app

Cons

- They basically only do cash-based accounting, even for the most expensive plans

- No free trial

Final thoughts

Xendoo would be right up there with the greatest bookkeeping software if it weren’t for that snag with accrual-based accounting. Most virtual bookkeeping services offer this but we understand the business decision that in order to maintain a low price, something’s got to go.

Still, some small businesses would be more than happy with cash-based accounting, which is available for all plans.

If you don’t know what accrual-based accounting is, let’s just say that you need it if you:

- Run an e-commerce store (because of your return policy, you must rely on accrual-based accounting)

- Run a high-volume business (property management, vehicle sales, vacation planning, grocery stores, bail bonds)

- Have a robust inventory management

- Work with different contractors for your projects

If you found yourself in the list above then Xendoo is probably not for you, especially if you’re just starting. That’s because they offer modified accrual bookkeeping for the two most expensive monthly plans (Thrive at $495 and Venture at $945).

If the following accrual-based services and reports are enough for you, then Xendoo could be your bookkeeping heaven: loans payable, month-end inventory adjustments, AR and AP reports (only if you use invoice and billing in Xero or QuickBooks Online).

Bookkeeper.com – champions of additional services

One of the most extensive virtual bookkeeping services out there, Bookkeeper.com comes with excellent solutions for your payroll and tax filing woes and neatly-segmented payment plans. It also offers longer onboarding than most of its competitors.

- Dedicated bookkeeper and account manager

- Bank/Credit card reconciliation

- Balance sheet, P&L, statement of cash flows

- Both cash and accrual-based accounting

- Secure document storage (limited only for the small business plan)

- Online Support

Pricing

Bookkeeper.com offers three fixed monthly pricing plans – small business at $499, small business plus at $649 and small business advanced at $849. There’s also a custom pricing plan if you make more than 300 monthly transactions or need a higher level of customization to what other plans have to offer.

Pros

- Free trial (limited services)

- Available for both cash and accrual-based accounting

- Bills monthly for all plans fixed plans

- Some of the payroll services you can get from Bookkeeper.com are:

- Major tax liabilities (federal, state & local, unemployment)

- Federal tax liabilities

- Quarterly and year-end tax forms

- Tax deposit services

- W-2 and 1099 filing

- Some of the tax prep services available are:

- Individual tax preparation

- Business tax preparation

- It’s integrated with Bill.com so you can handle bill pay through it

- It’s integrated with QuickBooks

- It has advanced features that you can use once you grow your small business like financial advisory and CFO advisory services

Cons

- Might not suit you if you make a lot of small monthly transactions, as its pricing is based on transaction volume

- Integrated only with QuickBooks

- No mobile app

Final thoughts

Bookkeeper.com does cost more than your average bookkeeping software but it also does more for you than your average bookkeeping software. Because of the sheer number of additional services it offers, you’ll never need to switch your virtual bookkeeping allegiance, once your small business grows.

FinancePal – tailor-made bookkeeping services for specific industries

- Startup

- Ecommerce

- Restaurant/bar

- Real estate (brokers, agents, investors)

- Hotel and hospitality industry

- Construction

- Rental

FinancePal’s list of bookkeeping, tax prep and consulting, payroll and other accounting services are truly extensive, which is why it covers almost as much ground as Bookkeeper.com. Another reassurance of the company’s expertise is the fact that it is founded by tax experts Community Tax.

It has one snag though, and that’s the fact that the pricing is strictly quote-based. There isn’t even a ballpark figure. On the other hand, you’ll get the quote quickly and you can choose to pay on a monthly or annual basis.

Pros

- Free trial available

- Monthly and annual plans available

- Dedicated bookkeeper

- Cash and accrual-based accounting available

- Industry-specific bookkeeping available

- US-based team

- Great integration (QuickBooks, QuickBooks Time, Gusto, Hubdoc, Bill.com, ADP)

- Catch-up bookkeeping available

- Bill pay available

- Bookkeeping services include:

- Transaction recording

- Income statement preparation

- Balance sheet preparation

- Payroll

- Small business tax prep includes:

- Checking account reports

- Quarterly payroll tax returns

- Annual payroll tax returns

- Preparation of W-2s, 1099s, and other tax forms

- Preparation of annual income tax returns

- Sales tax consultations are available

- Balance sheets include A/P and A/R

Cons

- Pricing is strictly quote-based

- No longer integrated with Xero

Final thoughts

As a brainchild of Community Tax, an established tax resolution service, FinancePal is your trusted bookkeeping ally on your way to growing your small business, tackling taxes and handling any accounting challenges that come your way. Similar to Bookkeeper, the amount of its additional services makes FinancePal ideal for fast-growing businesses.

Kruzeconsulting.com – virtual bookkeepers for venture capital startups

We couldn’t leave out a bookkeeping service specialized for the needs of fast-growing startups. There aren’t many out there that focus on startups, even fewer can handle venture capital-funded ones. Kruze consulting does and it does it with a bang.

Their accountants and bookkeepers have hands-on experience with VC-funded startups and they know how to properly file seed investments. Also, since most VC-backed small businesses depend on continued funding, Kruze consulting is their solace when tackling venture capital due diligence.

The range of their additional services is astonishing and it ranges from everything bookkeeping, financial modeling, tax prep, tax return to CFO consulting and VC & MA support. To handle all these add-ons, Kruze consulting is integrated with a myriad of accounting, payroll, bill pay and PCI software like Quickbooks, Gusto, Bill.com and much more.

Being that their sole purpose is to help startups with VC backing handle finances, Kruze consulting’s pricing is more than fair. If you’re an early-stage startup, you can use their basic package that starts at $325/month and upgrade it as your business grows. There is that $750 onboarding fee, though.

Pricing

- Basic Bookkeeping (from $325/month)

- Founder Timesaver (from $425/month)

- Premium (quote-based)

If you are a VC-backed startup, you should seriously consider Kruze consulting as your virtual bookkeeper for the following reasons:

- US-based accountants and bookkeepers with at least 11 years of experience in VC-related bookkeeping

- Incredible software integration: Quickbooks, Netsuite, Chargebee, Remote, Deel, Gusto, Rippling, Trinet, Justworks, Ramp, Brex, RHO business banking, Stripe, Airbase, Vouch, Bill.com, Shopify, Charthop, Carta, Avalara, Expensify

- They do startup 409a valuation

- Many startup tips are available for free on the website

- Many tax calculators available on the website

- Tax return services for seed stage, series a, series b and series c startups from $1500

- Corporate income tax return available as an add-on for every package

- Their virtual bookkeeping includes: recording transactions, revenue recognition, bank reconciliation, bill pay, financial statements prep

- Catch-up bookkeeping available

- M&A support available

Cons

By reading this far, you could have already noticed that Kruze consulting is struggling with clarity regarding what bookkeeping services you can expect from the two fixed-price packages. Here are some other issues we found while researching this virtual bookkeeping service:

- No free trial

- Unclear scope of accrual-based accounting available

- Inventory services for product-based small businesses only available in the custom quote-based price plan

- No mobile app

Final thoughts

If you are a funded Delaware C-Corp with half a million in seed or VC financing, you should look nowhere else but Kruze consulting. They are specialized for such startups.

This shouldn’t discourage you if your funding is structured differently or even if you are an early-stage startup that hasn’t been recognized by a venture capitalist yet – this virtual bookkeeping company lives and breathes startup bookkeeping and you should definitely give them a shot.

Shoeboxed—award-winning receipt management

One of the most tedious things about doing your own bookkeeping is spending hours manually entering receipt data into an accounting system.

You don’t have to live this way.

Voted by Hubspot as the best receipt scanner app for tax season, Shoeboxed is the only app that will handle both paper and digital receipts, saving customers up to 9.2 hours per week from manual data entry.

Plan types are divided into Digital Only plans which are available via the Shoeboxed iOS app, and Magic Envelope plans, available on their website, which combines data entry for both paper receipts and digital receipts.

When users sign up for a Magic Envelope plan, they stuff receipts into a postage-paid envelope that is then sent for scanning at the Shoeboxed facility in Durham, NC.

Receipt data is then entered into the customer’s account and automatically assigned 1 of 15 common tax categories.

Not only does Shoeboxed provide a receipt scanning service for physical receipts, but it also comes with robust receipt management software (web, iOS, and Android), allowing users to manage business expenses, create expense reports, track mileage, store business card contacts, and much more!

Pricing

- Magic Envelope plans (for those who want to outsource data entry) start at $18 per month (billed annually)

- Digital Only plans (available in their iOS app) start at $4.99 per month

- 30-day free trial

Pros

- Various ways to capture receipts—web app + iOS app for drag and drop or scanning expenses while on the go

- Gmail receipt sync feature for capturing e-receipts

- iOS app includes a mileage tracker for logging business miles

- Unlimited number of free sub-users

- Easily search and filter to find warranties and receipts

- Audit proof your business with IRS-approved receipt storage

- Automatic categorization of receipt data into common tax categories

Cons

- The mileage tracker is manual, so the app won’t automatically log your drives. However, this makes it easier to separate personal from business trips on your mileage log

- No budget feature

Final thoughts

Given the Trusted Vendor and Quality Choice awards by Crozdesk, Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture.

The Magic Envelope service is a particularly notable option for business owners looking for an easy way to regain hours of their time so that they can focus on what they do best.

Virtual bookkeeping service head-to-head

What to look for in a virtual bookkeeper

Now that you know what these virtual bookkeeping services can do for your business, it’s time to see which one of them has just enough features to satisfy your business needs. Below are some of the questions that can help you filter the perfect virtual bookkeeper for you.

- Is it synced to an accounting software of your choice (QuickBooks, Xero, Sage)?

- Does it fit your bookkeeping budget?

- Does it use cash-based, accrual-based accounting or both?

- Does it offer accounting add-ons like tax filing, payroll, back-office?

- Does it offer a free trial with no credit card details needed?

- Are its accountants US-based and CPA-licensed?

Wrap-up party

There you have it, our top six picks for virtual bookkeeping should provide enough help on the accounting end for any small business with various speeds of growth. All of them offer basic bookkeeping that should be enough for you as you slowly grow and all of them pack enough additional services to stay with you as you scale up. Should you decide to try out another virtual bookkeeping provider, they’re integrated with all the right software so that your switch can be seamless.