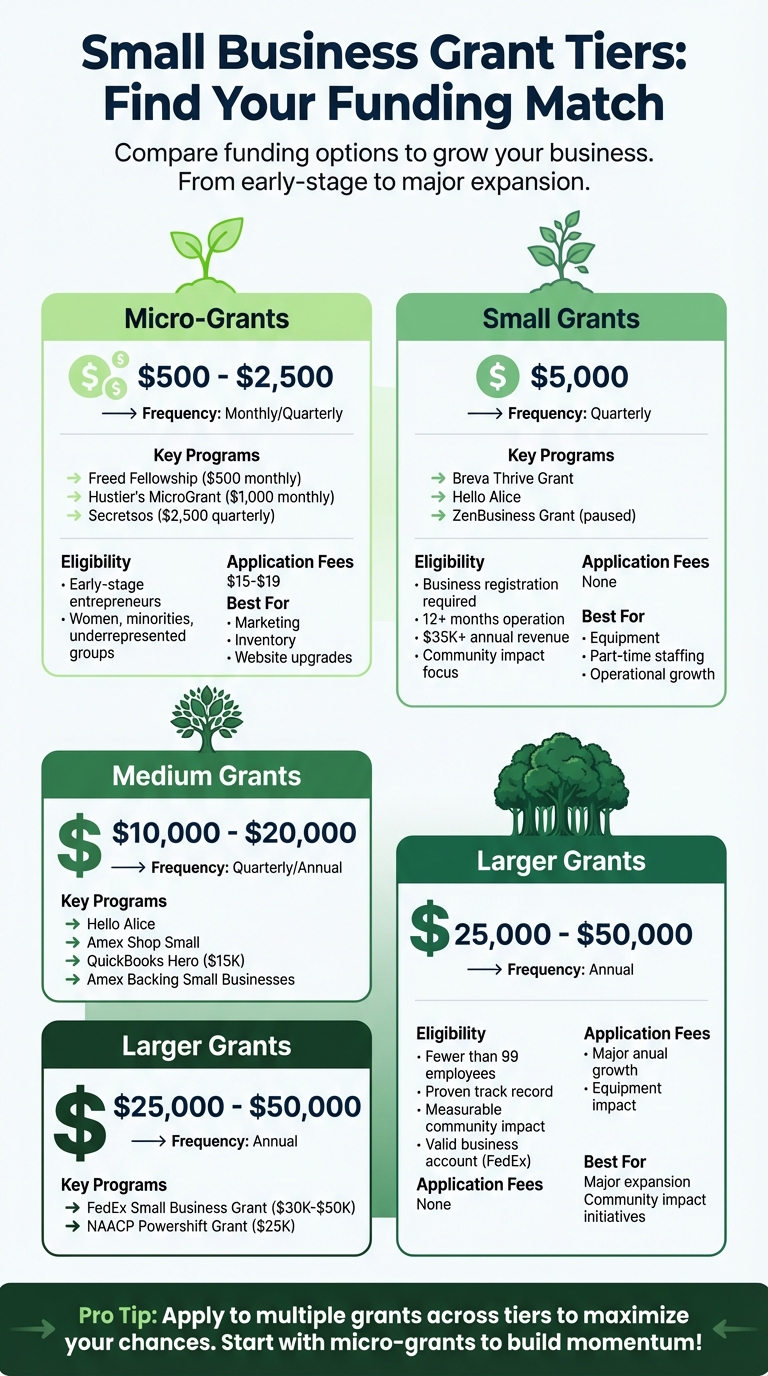

Securing funding for your small business doesn’t have to mean loans or giving up equity. Small business grants provide free money to grow your business while keeping full ownership. This guide highlights over 12 U.S. grant programs, offering amounts from $500 to $50,000. Opportunities are organized by funding tiers – micro-grants, small, medium, and larger grants – making it easier to find what fits your needs.

Here are some key options to consider:

- Micro-Grants ($500-$2,500): Freed Fellowship, Hustler’s MicroGrant, and Secretsos offer monthly or quarterly funds for early-stage needs like marketing or inventory.

- Small Grants ($5,000): Breva Thrive Grant supports businesses impacting underserved communities.

- Medium Grants ($10,000-$20,000): Programs like Hello Alice and the Amex Shop Small Program help with expansion.

- Larger Grants ($25,000-$50,000): FedEx Small Business Grant Contest and NAACP Powershift Grant prioritize businesses with strong community impact.

Pro Tips:

- Prepare a strong business plan, clear financial data, and a polished online presence.

- Watch for scams – legitimate grants never guarantee approval or charge high fees.

- Apply to multiple grants to increase your chances.

Start with accessible options like Freed Fellowship or Hello Alice and build momentum for larger opportunities. Visit trusted platforms like Grants.gov and SBA.gov for updates.

US Small Business Grant Tiers: Funding Amounts and Eligibility Requirements

Micro-Grants ($500-$2,500)

Micro-grants offer crucial support for specific business needs, like upgrading your website, purchasing inventory, or funding marketing efforts. These smaller grants often come with straightforward applications and quicker decisions compared to larger grants. Here are three micro-grant opportunities that stand out for their benefits and simple application processes.

Freed Fellowship

The Freed Fellowship awards $500 each month to one U.S. small business owner, with the chance to win an additional $2,500 year-end grant. Applications close at midnight Eastern Time on the last day of each month. This grant is open to all U.S.-based micro and small business owners, with a particular focus on women, minorities, and other underrepresented groups. Nonprofits are not eligible, and there is a $19 application fee to cover review costs.

What makes the Freed Fellowship unique is the feedback provided to every applicant. Each submission receives a "Freed Score", based on the 5C Framework (Context, Content, Community, Chemistry, and Commerce), along with growth recommendations and two months of free mentorship. This ensures that even applicants who don’t win gain valuable insights to help their business grow.

"The Freed Fellowship is an accessible source of feedback for aspiring but overlooked business owners who want their vision to be seen and heard." – Freed Fellowship

Apply here: https://freedfellowship.com

Hustler’s MicroGrant

The Hustler’s MicroGrant offers $1,000 monthly to U.S.-based small business owners and entrepreneurs. Organized by Deja Vu Parker of WBLS and HerSuiteSpot, this grant is specifically designed to support women and underrepresented groups aiming to expand their businesses. Applications are accepted on a rolling monthly basis, and there is no mention of an application fee. This grant is part of a broader initiative to address various business needs.

Apply here: https://www.hersuitespot.com/hustlersgrant/

Secretsos

The Secretsos Small Business Grant provides $2,500 every quarter to small businesses in the U.S.. Deadlines fall on the last day of each quarter (March 31, June 30, September 30, and December 31). This grant is targeted toward underserved entrepreneurs, including women, veterans, minorities, and those in low-income areas. However, certain states are ineligible, so it’s important to confirm your eligibility before applying. A $15 application fee applies.

In addition to the cash award, grant recipients gain access to a supportive community offering mentorship, skill-building workshops, and networking opportunities. Winners also receive a professional website from UENI, which can enhance their business’s credibility.

Apply here: https://secretsos.com/grants/

Small Grants ($5,000)

Small grants of $5,000 can provide essential support for equipment purchases, part-time staffing, and operational growth as you start a small business. Below are details on key programs offering funding at this level.

ZenBusiness Grant

Current Status: As of January 2026, the ZenBusiness Grant Program is paused and not accepting applications. When active, this program awarded $5,000 to entrepreneurs who had formed their business through ZenBusiness within the previous 3 to 6 months. Eligible applicants had to be at least 18 years old, U.S. citizens or permanent residents, and active paying customers of ZenBusiness. There was no application fee.

Past recipients used the grant for various needs, including tools, facilities, and capacity building. Ambrosia Crump, founder of Dignity Disability Solutions LLC, shared her experience:

"The grant money has helped me secure a private mailbox where my homeless clients can receive their social security correspondence, pay my membership dues to professional organizations, and paid for my ability to attend trainings to improve my advocacy skills."

For updates on the program’s status, visit ZenBusiness Impact.

Breva Thrive Grant

Another prominent $5,000 funding opportunity comes from the Breva Thrive Grant.

This grant is awarded quarterly to for-profit businesses that demonstrate measurable impact in underserved or underrepresented communities. The next application deadline is January 31, 2026, with additional rounds closing on the last day of April, July, and October. There is no application fee.

To qualify, businesses must be legally registered, operating in the U.S. (including D.C., Puerto Rico, and U.S. Territories), and generating revenue. Applicants should ideally have at least 12 months of operations and a minimum annual revenue of $35,000.

Applications are judged on four key criteria:

- Community Impact (40%): Highlight measurable outcomes, such as jobs created in low-income areas or services provided to underrepresented communities.

- Business Viability (30%): Demonstrate the sustainability and strength of your business model.

- Program Alignment (20%): Show how your goals align with the grant’s mission.

- Fund Use (10%): Detail how the grant will be put to use.

Recipients receive unrestricted funding – no repayment or equity required. Previous winners include A Place at the Table, a pay-what-you-can cafe that has served over 108,000 meals, and Rohi’s Readery, a bookstore focused on inclusive education. Applicants should prepare 12 months of bank statements and clearly defined metrics showing their community impact.

A polished online presence can also enhance your application. Tools like UENI can help you create a professional website that highlights your business’s legitimacy and community contributions.

Apply here: Breva Thrive Grant

Medium Grants ($10,000-$20,000)

Medium grants provide funding between $10,000 and $20,000 for small businesses that have been operating for at least a year and can show documented revenue. These grants are designed to help businesses expand their operations. Here are four noteworthy programs offering support at this funding level.

Amex Shop Small Program

The Amex Shop Small Program offers $10,000 grants to businesses that make a positive impact on their local communities. Administered by Main Street America, this program focuses on supporting businesses that boost local economies and foster meaningful connections with customers. To qualify, businesses generally need to meet SBA size standards, such as having fewer than 500 employees for manufacturing or annual receipts under $7.5 million for non-manufacturing.

Applicants must detail their local impact and growth plans, including their NAICS code and measurable outcomes.

Apply here: Amex Shop Small Program

Intuit QuickBooks Hero Program

The Intuit QuickBooks Hero Program awards $15,000 to small business owners who demonstrate strong community contributions and solid business performance.

To apply, you’ll need to provide documentation showing your business’s community impact, financial stability, and plans for using the grant. Include details such as your revenue history, metrics on community engagement, and specific goals – like the number of people served or partnerships formed.

Apply here: Intuit QuickBooks Hero Program

Hello Alice Grant

Hello Alice offers grants ranging from $10,000 to $20,000 through various funding cycles. These grants are targeted toward new or underserved businesses. When applying, emphasize how your business supports underrepresented communities and back your application with strong financial data.

Apply here: Hello Alice Grants

American Express Backing Small Businesses

The American Express Backing Small Businesses program provides grants of $10,000 to $15,000 to businesses focused on growth. Eligible applicants must meet SBA size standards and have been in operation for at least one year. Applications should include detailed expansion plans supported by budgets, revenue forecasts, and market analysis.

Apply here: American Express Backing Small Businesses

Larger Grants ($25,000-$50,000)

Securing larger grants often requires showcasing a solid track record and clear potential for growth. These programs usually favor businesses with measurable success, well-defined strategies, and a tangible impact on their communities.

FedEx Small Business Grant Contest

The FedEx Small Business Grant Contest offers $30,000 to $50,000 to small businesses across the United States. In 2023, FedEx awarded $30,000 each to 10 winners, with an additional $20,000 grant for a veteran-owned business, courtesy of USAA Small Business Insurance. For example, BAYDOG, a veteran-owned business, received a total of $50,000 through this program.

To qualify, applicants must meet specific criteria: your business must be for-profit, have fewer than 99 employees, and maintain a valid FedEx shipping account. Nonprofit organizations, franchises, direct sellers (like Mary Kay), and businesses directly competing with FedEx in shipping or printing are not eligible.

A strong application is key. FedEx emphasizes the importance of clear and engaging essays that align with their brand. As they explain:

"A selection committee within FedEx will select the top 100 finalists… using elements [including] clear, compelling, and engaging essay answers."

Additionally, judges evaluate your online presence, including social media activity, customer reviews, and website functionality. For instance, The Cupcake Collection, a 2023 winner, stood out with high-quality visuals and a compelling company story.

While the exact timeline for the 2026 contest hasn’t been released (as of January 7, 2026), the application period typically begins in late January or February. Consider preparing a two-minute video to showcase your business story and innovation – it can make a big difference.

Apply here: FedEx Small Business Grant Contest

Other grants, like those offered by the NAACP, focus on empowering entrepreneurs through initiatives rooted in community and social equity.

NAACP Powershift Grant

The NAACP Powershift Entrepreneur Grant offers $25,000 to Black entrepreneurs and businesses dedicated to advancing social justice. This grant aims to address the funding gap that disproportionately affects Black-owned businesses. As the NAACP explains:

"Black-owned businesses need more access to capital and funding than ever before. So we’re doing just that."

In addition, the NAACP and Vistaprint have collaborated on the "Power Forward" program, committing $1 million to support Black-owned businesses in New England through $25,000 grants. These grants prioritize businesses that contribute to social justice, foster community engagement, or implement environmentally conscious practices.

When applying, focus on demonstrating your business’s community impact, commitment to social justice, and detailed plans for using the funds. Include supporting documents like operational records, revenue history, and growth strategies that align with the grant’s mission.

Apply here: NAACP Powershift Grant

How to Apply: Practical Tips

Ready to apply for grants? Here’s how to make the process smoother and more effective. Start by batching your grant applications quarterly. Many major programs – like ZenBusiness, Breva Thrive, and Secretsos – follow quarterly cycles, with deadlines typically landing in March, June, September, and December. Mark your calendar for the beginning and end of each quarter to stay on top of these dates.

Make sure your business is legally registered and has a dedicated business bank account. Programs such as Secretsos, Breva Thrive, and ZenBusiness often require official documentation and won’t send funds to personal accounts.

Create a concise, one-page business summary. Include your mission statement, what makes your business stand out, revenue figures (or projections), and a clear plan for how you’ll use the funding. This document can save you time when applying to multiple grants.

Consider assembling a media kit. Include high-quality images, your logo, a 500-word company bio, and – if required – a two-minute video pitch. For example, the FedEx contest asks for a video showcasing your story and how your business impacts the community.

Here’s a quick breakdown of grant tiers to help you plan:

| Grant Tier | Funding Amount | Typical Frequency | Key Eligibility |

|---|---|---|---|

| Micro-Grants | $500 – $2,500 | Monthly | Great for early-stage entrepreneurs; may have small application fees ($15–$19). |

| Small Grants | $5,000 | Quarterly | Requires business registration and proof of community impact. |

| Medium Grants | $10,000 – $20,000 | Quarterly/Annual | Often for businesses with at least 1 year in operation and revenue under $1M. |

| Larger Grants | $25,000 – $50,000 | Annual | Competitive; may require being a customer of the grant sponsor (e.g., FedEx). |

To make your application even stronger, track your community impact metrics throughout the year. Keep records of customer ZIP codes, employee demographics, and local partnerships. Programs like Breva Thrive, for instance, may weigh community impact as 40% of your total score.

Finally, ensure your online presence is polished. Tools like UENI can help you establish credibility and demonstrate your business’s legitimacy – both of which can impress grant reviewers. These steps will help you stand out in the competitive world of grant applications.

sbb-itb-5b82b38

Common Grant Myths Explained

Let’s set the record straight on some common misunderstandings about small business grants. First off, the SBA does not provide grants for starting or expanding a business. Instead, SBA grants are reserved for nonprofits, educational institutions, and resource partners that run counseling and training programs. The only exceptions are specific initiatives like the SBIR and STTR programs, which fund scientific research and development, or the STEP program, which supports export growth efforts.

"SBA does not provide grants for starting and expanding a business."

– U.S. Small Business Administration

Another misconception is that Grants.gov lists funding options for individual startups. It doesn’t. Federal agencies don’t publish startup funding opportunities for individual business owners on this platform. Grants.gov is designed to showcase government-funded programs managed by organizations and other entities. For context, in fiscal year 2025, the average SBA microloan was $16,131 – a loan that must be repaid with interest, not free money.

Application Fees and Guaranteed Approvals

Here’s another myth: all legitimate grants are free to apply for. While federal grants never charge application fees, some private grant programs may ask for small administrative fees, usually between $15 and $20. For example, Freed Fellowship charges $19, while Amber Grant and Secretsos each charge $15. However, federal grants will never require a "processing fee" or payment to access an application.

Lastly, beware of anyone guaranteeing grant approval. Small business grants are highly competitive, and any promise of guaranteed funding in exchange for an upfront payment is likely a scam. To stay safe, remember that official SBA communications will always come from an email address ending in @sba.gov. Similarly, major corporations like FedEx will not notify grant winners through social media.

Warning Signs of Grant Scams

When working on grant applications, it’s important to stay alert to scams that target hopeful applicants. One major warning sign? Unsolicited messages on social media. If you receive a message on Facebook, Instagram, or LinkedIn claiming you’ve won a grant from FedEx or another big-name company, be skeptical. According to FedEx: "FedEx does not contact you about a grant via messages on any social media platform". Block and report such accounts immediately. This is just one example – always scrutinize communication carefully.

Another key point: The SBA only uses email addresses ending in @sba.gov. If someone contacts you claiming to represent the SBA, check their email address. The SBA states: "If they are not using an official SBA email address, you should suspect and report fraud". Legitimate federal grant communications will always come from a .gov domain, and the associated website will feature a lock icon and https:// in the URL.

Be wary of offers that seem too good to be true. Anyone guaranteeing grant approval in exchange for an upfront fee is likely a scammer. While some private grants may require small administrative fees (typically $15–$20), federal grants never charge "processing fees" to access applications. If someone demands payment upfront, it’s a red flag.

Misinformation about grant eligibility is another common tactic. Scammers may claim that SBA grants can fund start-ups or business expansion, but that’s simply not true – SBA grants do not cover these purposes. If someone tells you otherwise, they are either mistaken or attempting to deceive you.

To protect yourself, always verify opportunities through trusted sources like Grants.gov, your local Small Business Development Center (SBDC), or the SBA Answer Desk at 1-800-827-5722. Building a professional online presence, such as with tools like UENI, can also enhance your credibility and help you stand out when applying for grants in 2026.

Where to Find More Grant Opportunities

After submitting your applications, it’s a good idea to keep searching for new funding options. The grant world is constantly changing, with fresh opportunities popping up throughout the year. Here are some reliable platforms to help you stay on top of things:

- Grants.gov: This is the go-to database for federal grant opportunities, offering access to over 1,000 programs from various government agencies. It’s free to use and even has a mobile app to track opportunities. Keep in mind, though, that Grants.gov primarily focuses on funding for organizations – such as research initiatives, tech projects, and public programs – rather than personal financial aid. It also includes a handy Grants Learning Center with application checklists and policy guides.

- SBA.gov: While the Small Business Administration (SBA) doesn’t usually provide direct grants for starting or expanding businesses, it does manage specialized programs like SBIR/STTR grants for research and development and STEP grants for exporting. Additionally, the SBA connects you with local Small Business Development Centers (SBDCs), which can help you find regional grant opportunities with less competition.

- Hello Alice: This platform provides personalized weekly grant recommendations tailored to your business profile. With a community of over 1,000,000 entrepreneurs and more than $13 million in grants awarded in 2022, it’s become a popular resource for small business owners.

- GrantWatch: GrantWatch lets you track federal, state, local, and foundation grants. However, accessing full application details requires a paid membership.

- Local Resources: Don’t overlook regional opportunities. Check state Secretary of State websites, local Chambers of Commerce, and Minority Business Development Agency (MBDA) centers for grants specific to your area. Regional grants often have fewer applicants, giving you a better shot at securing funding.

These platforms are great tools to stay informed about evolving grant options. To enhance your credibility when applying, consider building a professional website. Services like UENI can help you establish a strong online presence, which could make a big difference in 2026 and beyond.

Conclusion

Explore 12 grant opportunities ranging from $500 to $50,000, designed to help small businesses and startups grow without taking on debt or giving up equity. While grants are highly competitive, they’re within reach if you approach them with a strong business plan, accurate financial data, and a polished online presence.

Ready to take action? Here’s your next step: Apply to three grants this month. Start with the Freed Fellowship ($500, monthly), Hustler’s MicroGrant ($1,000, monthly), and Hello Alice (rolling applications). These options cover different funding levels and give you a chance to refine your application process. Plus, many programs offer extra perks like mentorship and strategy sessions, so even if you don’t win, you’ll gain valuable insights to improve future applications.

Before submitting, make sure your online presence is up to par. Grant reviewers often assess your website’s usability, how visible your products or services are, and your activity on social media. A professional website built through platforms like UENI can showcase your operational readiness and leave a strong impression.

Stay prepared by keeping a "Grant Kit" handy. Include an updated business plan, revenue projections, and your mission statement so you’re ready as soon as application windows open. Regularly check resources like Grants.gov, SBA.gov, and Hello Alice for new opportunities. Don’t forget to explore local Small Business Development Centers, which often feature regional grants with less competition.

Don’t wait – pick three grants and set aside time this week to complete your applications. Each step brings you closer to securing the funding you need to grow your business.

FAQs

What are the best strategies to improve my chances of getting a small business grant?

To boost your chances of securing a small business grant, focus on thorough preparation, finding the right opportunities, and submitting a polished application. Begin by seeking out grants that match your business’s type, industry, and location. Double-check that you meet all eligibility criteria – any application that doesn’t qualify will be dismissed immediately.

Create a brief, 1-page summary that includes your business name, mission, how you plan to use the funds, and the positive impact the grant will have. Gather essential documents in advance, such as your business registration, tax ID, and financial records, so you’re not scrambling at the last minute. Applying to grants consistently, perhaps on a quarterly basis, can help you make the most of available opportunities.

Stay alert for scams – real grants won’t ask for upfront fees or promise guaranteed funding. Having a professional online presence, like a well-designed website and cohesive branding, can also make your business more appealing to reviewers. Take the first step today by applying to three grants this month!

How can I spot common grant scams?

When applying for grants, it’s crucial to keep an eye out for red flags that could indicate scams or fraudulent offers. Be wary of any requests for upfront fees or so-called "processing" payments. Promises of guaranteed approval are another warning sign, as legitimate grants never guarantee funding. Also, avoid engaging with communications sent from unofficial email addresses – anything that doesn’t end in .gov should raise suspicion.

Pay attention to website details, too. If the site lacks a secure "https" in its URL, think twice before proceeding. Additionally, claims that the SBA provides direct startup grants are false – they simply don’t offer such funding. To stay safe, always cross-check opportunities with trusted and official sources. And remember, if an offer seems too good to be true, it probably is.

Do I have to pay any fees to apply for small business grants?

No, real small business grants will never ask for an application fee. If someone requests payment upfront, it’s almost certainly a scam. Always double-check the legitimacy of the grant program before providing any personal or financial details.